ETF Benefits for Investors

Exchange traded funds (ETFs) are a popular portfolio tool, thanks in part to their trading flexibility, low costs, and tax efficiency. Plus, they can help investors diversify with broad or targeted exposures.

Since debuting in 1993, the ETF industry has grown tremendously. Today, institutional and individual investors use ETFs in a myriad of ways to help meet their investment goals.

7 Key Benefits of ETFs

An ETF is a basket of securities that can be bought and sold in a single trade on a stock exchange. ETFs deliver diversified, low-cost, transparent, and tax-efficient exposure to assets across the globe. Understanding these ETF benefits can help you decide how ETFs may fit into your portfolio.

1. Portfolio Diversification

ETFs provide one of the easiest ways to diversify a portfolio. Much of the ETF landscape is comprised of index ETFs, which seek to track the performance of benchmark indexes containing many individual securities. In fact, ETFs first rose to prominence as effective passive investment vehicles.

By using ETFs to spread investments quickly across asset classes, geographies, and sectors, investors can lower the risk that weak returns from an individual security could hurt overall portfolio performance. And by increasing portfolio diversification, ETFs offer the potential for improved risk-adjusted returns.

2. Wide Variety of Investment Choices

As the ETF industry has exploded, so too has the number of market exposures available within ETFs. Investors can use ETFs to meet their investment objectives by conveniently accessing both broad and targeted exposures, including:

- Asset classes – Equities, fixed income, commodities, currencies alternatives, multi-asset

- Geographies – Global, regional, developed markets, emerging markets, single country

- Sectors, industries, styles – Equity exposures such as biotech, insurance, transportation, growth, value, large/mid/small cap; fixed income exposures such as high yield, bank loan, aggregate

- Investment themes – Multi-generational themes such as environmental, social & governance (ESG), technological advances, new consumer, urbanization

- Factors, smart beta – Dividend, growth, momentum, size, value, volatility

3. Low Cost

Because most ETFs are passively managed, they typically have lower management fees and operating expenses compared to mutual funds. Transaction costs are minimized due to the low turnover of most ETFs and the indexes they track. When fees and expenses are low, investors can keep more of their returns.

How much lower are ETF costs? Both ETFs and mutual funds have an expense ratio, which includes management fees and the fund’s total annual operating expenses. The average expense ratio for index ETFs is lower than that of index mutual funds, historically 0.57% for ETFs versus 0.84% for mutual funds.1

Additionally, ETFs trade commission-free on many brokerage platforms, which can lower the total cost of owning an ETF.

4. Added Liquidity

In times of market volatility, liquidity is vital. Investors want to be able to buy and sell securities quickly, easily, and at an attractive cost. ETFs are unique in that their liquidity is supported by two trading markets.

In the secondary market, where most investors trade, ETF liquidity is provided by ETFs trading on an exchange. Because they trade throughout the day in the secondary market, investors can make timely investment decisions and quickly execute based on shifting market conditions.

Secondary market liquidity is enhanced by the primary market liquidity of each ETF’s underlying securities. This primary market liquidity is sometimes even greater than an ETF’s secondary market liquidity.

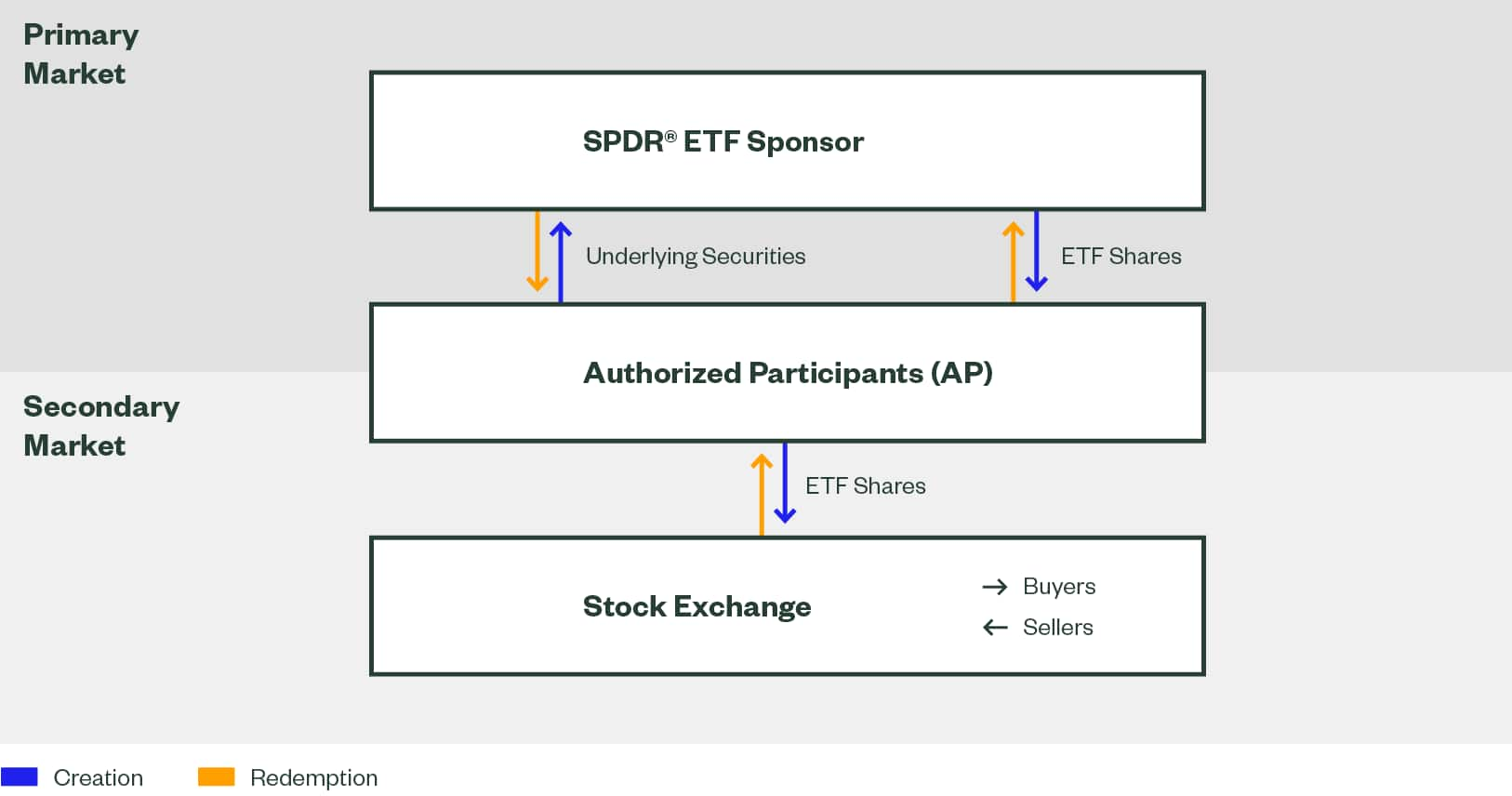

These two layers of ETF liquidity stem from how ETFs are created and redeemed. Creation involves buying all the underlying securities and wrapping them into the exchange traded fund structure. Redemption is the process whereby the ETF is “unwrapped” back into the individual securities.

This process sets ETFs apart from other investment vehicles and is the mechanism that underpins many of their benefits, from improved tax efficiency to enhanced liquidity.

How the Creation and Redemption Process Works

Source: State Street Global Advisors, June 4, 2023.

5. Transparency

The holdings of most ETFs are fully transparent and available daily. This disclosure means investors know what they own in real time, allowing them to make more informed investment decisions with greater accuracy.

6. Trading Flexibility

At any time during the trading day, ETF shares can be bought and sold through brokerage accounts at their current market prices, which may be slightly more or less than their net asset values (NAV). There are no minimum holding periods.

When trading ETFs, investors can employ a wide range of techniques to react to market movements, shift allocations, and deploy investment strategies, such as buying on margin, short selling, and placing limit orders.

The trading flexibility throughout the day offered by ETFs compares favorably to mutual fund shares, which are priced once at the end of the trading day. Mutual fund shareholders purchase and redeem shares at the fund’s closing NAV.

7. Tax Efficiency

Thanks to their tax-efficient structure, ETFs can help investors with taxable accounts keep more of what they earn. Because ETFs generally track market indexes, turnover is usually low, resulting in lower capital gains taxes.

ETFs also benefit from the ability to transfer securities in and out of the portfolio in the most tax-efficient manner, known as the in-kind creation and redemption process. When ETF investors sell their units on the exchange to other investors, the ETF portfolio manager does not need to buy or sell any of the ETF’s underlying investments.

In contrast, when an investor decides to sell shares of a mutual fund, the fund manager may sell a portion of the fund’s security holdings in order to deliver cash in the amount of an investor’s position. This sale may generate a realized taxable gain, and taxes on those gains are absorbed by the remaining shareholders in the fund.

Expand Your Knowledge of ETFs Even Further

Visit our ETF Education Hub to explore other ETF topics.